Rethinking Silicon Valley Cliché – Nine of Ten Ventures Fail!

According to a Fortune magazine article, it’s now a Silicon Valley cliché that nine of ten ventures fail!. Many reasons have been offered, from lack of market demand, to insufficient capital, arrogance, etc.

However, most ventures are selected for funding by experienced business people and investors who have successfully managed all stages of the Product Lifecycle. These funding organizations also conduct significant Due Diligence analysis before they decide to fund a venture, often judging based primarily on the quality of the Team.

I propose the 90% failure rate is due in large part to this focus on the Team. The team members are human: their decisions are based on their own personal preferences, passions, and prejudices which lead to unrealistic views of their products. A recent Princeton University study quotes: “People tend to show a ‘bias blind spot’ whereby they are unaware of (or ‘blind’ to) biasing influences on their own judgments…People deny being influenced by bias in large part because biases often occur unconsciously.”

As the funding organization’s focus is on the Team, they regard technical topics as tactics, and normally trust the Team to make significant technology related decisions and do not conduct effective and quantitative Research and Technology Due Diligence. According to the National Academy of Sciences report on the Best Practices in Assessment of Research and Development Organizations, “Peer review, coupled with quantitative and qualitative metrics, is a critical part of an effective assessment of the R&D organization … “

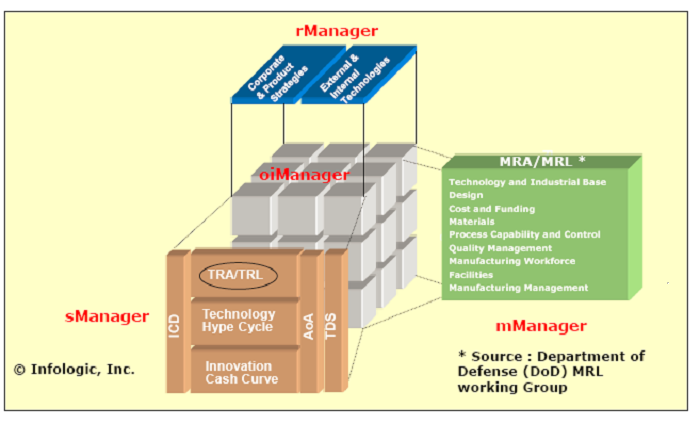

To reduce the venture failure rate, the funding organizations should adopt an Analytic-based Research & Technology Due Diligence model spanning the entire Product Life Cycle, from Research to Commercialization. The following figure depicts a suggested Due Diligence model based on (a) NASA developed methodology, called Technology & Manufacturing Readiness Levels (TRL/MRL), and (b) industry best practices, such as Technology Hype Cycle and Innovation Cash Curve.

At a recent lecture at the University of California, Irvine (UC Irvine) Applied Innovation center, I discussed this proposed Due Diligence model. The presentation slides are provided on The UC Irvine Cove SlideShare site.

# # #